Our strategy

For the past 25 years, Swiss Prime Site has been synonymous with the creation and design of living, working and leisure spaces. Today, we are the leading real estate company in Switzerland, with the experience and size to facilitate a more sustainable and value-oriented use of buildings in the future.

Our extensive experience in property development and letting has resulted in enduring relationships with our tenants and partners. It forms the foundation for our detailed understanding of market needs, both now and in the future, and gives us the ability to anticipate and shape trends.

We have around CHF 21 billion in property assets and this scale gives us a decisive advantage in extensively leveraging our experience and expertise. Our size means we can drive innovation in construction and building operations, develop large sites, offer a wide range of products and solutions, and set standards for sustainable buildings. Through our actions, we create long-term, sustainable value for our customers and society as a whole.

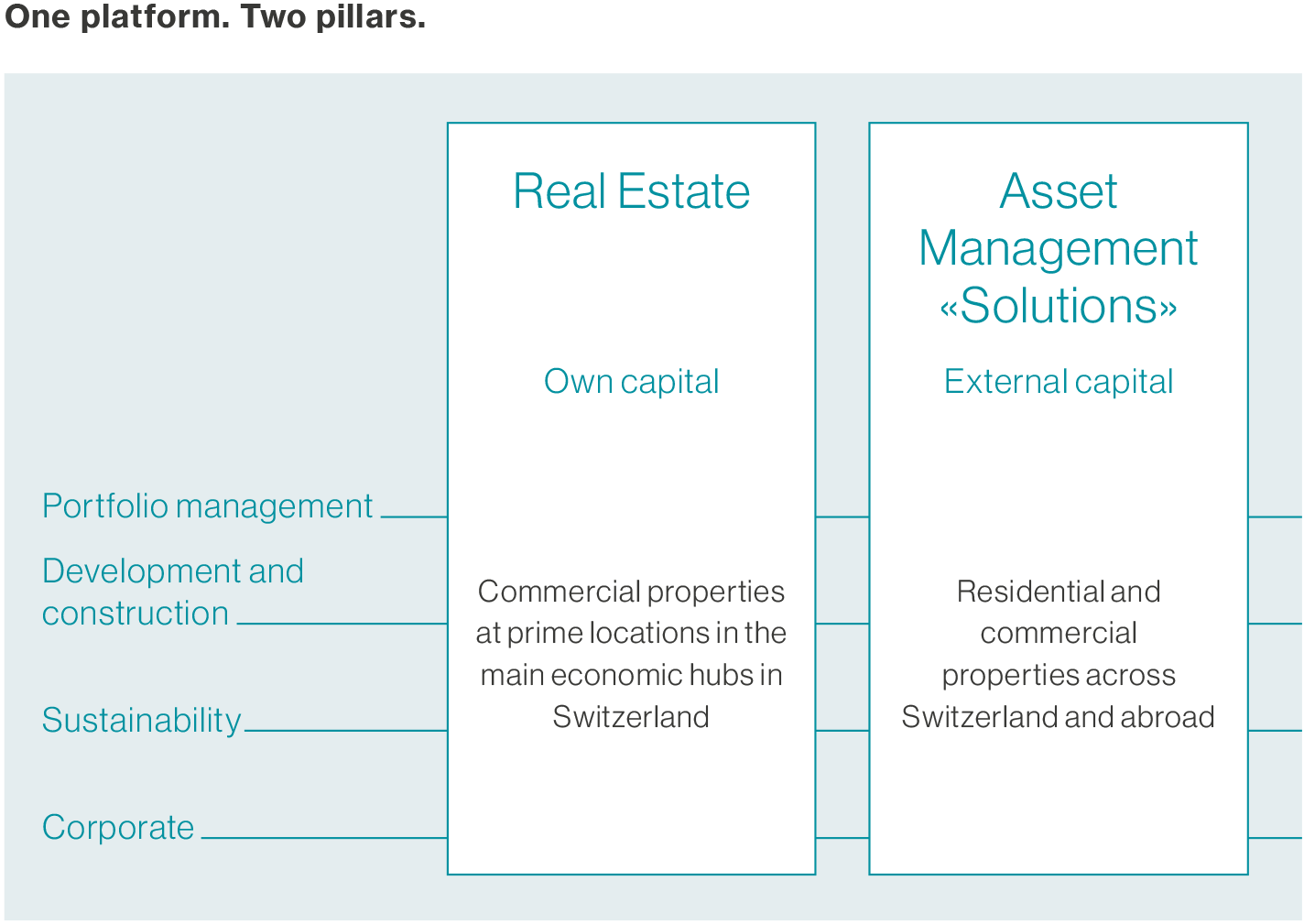

Our aim is to use our expertise as widely as possible – which is why we have created a platform that allows us to invest our own capital as well as external capital in property assets. Our strategy is based on two strong pillars: the Real Estate business area, in which we invest our own funds in commercial real estate, and the Asset Management business area, in which we invest external funds from investors, particularly in residential real estate.

Here, our size offers us advantages over other market players and we serve a particularly broad spectrum of investors and customers. Our specialist expertise in active portfolio management, in development and in sustainability can be applied across our entire portfolio to realise synergies. We also benefit from economies of scale in centralised functions such as finance and IT.

Real Estate business area

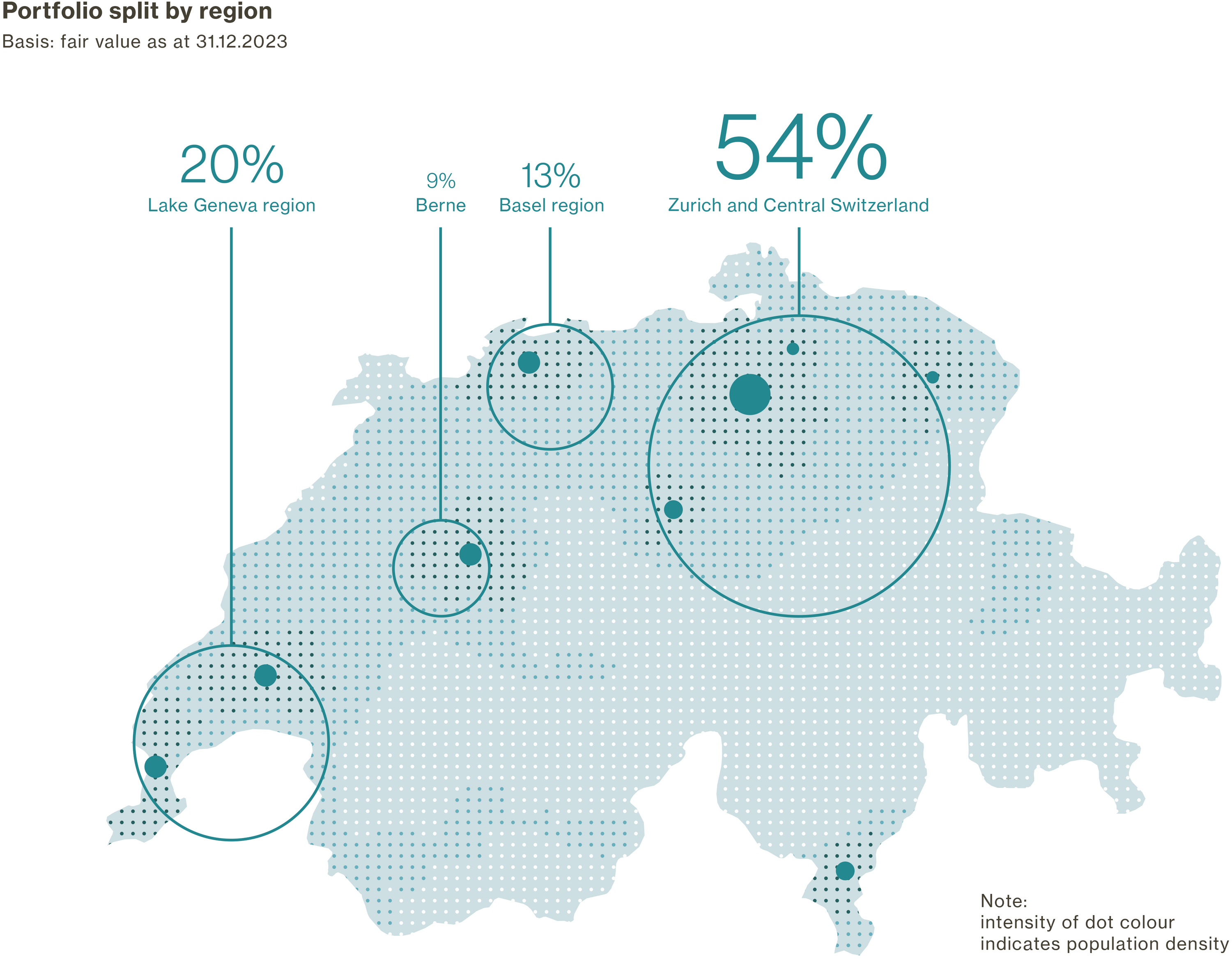

The Real Estate business area, which is consolidated into Swiss Prime Site Immobilien, lets and invests in commercial properties, chiefly in prime locations in the major Swiss economic centres of Zurich, Geneva, Basel and Bern. The real estate holdings are currently valued at CHF 13 billion and have a broad range of usage types. The largest share is office properties, followed by retail, logistics, infrastructure properties and other types of use.

We mainly invest in larger buildings and sites in central locations, where we cater to a very broad range of tenants through mixed use. Our tenant base, consisting of around 2 000 individual tenants, is highly diverse, and the concentration of properties and sites allows for efficient management of the portfolio.

By continuously implementing new development projects, tailored to each market, we can simultaneously generate added value for our stakeholders in the area and for our investors. With our developments, our portfolio is continuously held up to date and boasts particularly high building quality. To minimise risks, we only develop real estate for our own portfolio, work with general contractors, and start constructing new developments only when pre-letting reaches at least 50%.

We manage our portfolio proactively and have a solid equity base. This means that we mainly finance our growth through our own funds and make acquisitions and divestments where they enhance the portfolio. Our key evaluation criteria are the potential for income and value accretion, location, and type of use. Under our disciplined investment strategy, we also sell properties of limited potential that do not make an optimal fit for the portfolio as a whole. Overall, we aim to finance our developments and acquisitions through sales so that we always have a strong equity base. We call this strategy «capital recycling».

Portfolio in figures

13.1

CHF billion Real estate assets

159

Number of properties

1.7

Million m² Rental space

~ 2000

Tenants

Asset Management business area

The Asset Management business area, which is consolidated into Swiss Prime Site Solutions, has managed assets of CHF 8.4 billion and a development pipeline of CHF 1.1 billion. Swiss Prime Site Solutions is the leading independent asset manager in Switzerland with a fund management licence from the Financial Market Supervisory Authority (FINMA).

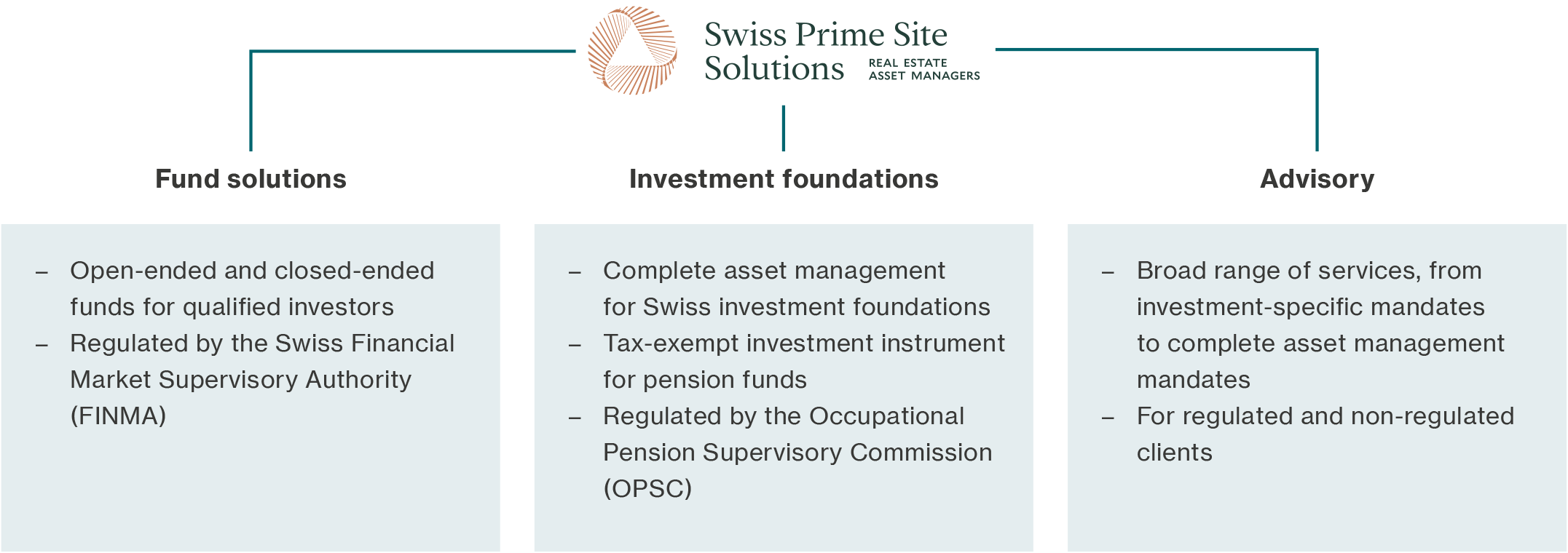

Our range of products includes (1) various (open- and closed-ended) fund solutions, (2) investment foundations for pension funds and (3) advisory serivces for external investors. The managed portfolio, with a diversified investment allocation focusing on residential properties, covers the whole of Switzerland and select regions abroad.

Through our wide range of products and services, we cater to various investor types and their preferences. The primary external sources of capital are institutional investors and pension funds. The Asset Management business area generates profitable growth through fee-related earnings without the need for us to invest our own capital.

Also within this business area, we provide comprehensive real estate services and cover the entire real estate life cycle including purchasing, development and construction management, rental and property management, and sales.

The products are largely invested in residential real estate. For pension funds, the risk-return profile makes this a favoured category. In contrast to the Real Estate business area, we also develop and acquire properties located outside the major economic hubs where potential income can be particularly attractive.

In the past three years, we have focused Swiss Prime Site’s business activities on our core business of real estate investments. We have sold off the areas that are not related to our core business. For example, in 2020 we sold the Tertianum Group, which specialises in assisted living, and in 2023 Wincasa, which focuses on property management. We also announced we will no longer be operating the Jelmoli department store after 2024 and will be repositioning the building.

AuMs by type of use

8.4

CHF billion Assets under management

5

Funds

~ 400

Number of properties

~ 600

Investors

Sustainability

Sustainability has been an integral part of our strategy and key to our business and value creation model since the early years of Swiss Prime Site. Our vision is to create sustainable living spaces. We believe that only buildings which can be built and operated sustainably will have a future. As a real estate company, we can make a significant contribution to mitigating climate change and we are aware of this responsibility. Our key priorities here are sustainable construction & development as well as sustainable use and operations. In both areas, we have set clear, ambitious goals – for example, using more than 50% renewable resources in construction by 2030, and achieving climate-neutral operations by 2040. Our dedicated employees strive every day to systematically implement the necessary measures.

We regularly validate and calibrate our sustainability strategy with a materiality analysis in which all our stakeholders are involved. The main topics here also span the social, economic and governance dimensions, and we take a specific, targeted approach in each case.

We provide comprehensive information about our sustainability strategy, progress, and achievements in our Sustainability Report.

Financing strategy

Real estate is a capital-intensive business, so a solid financing base is essential for our operational activities. Our focus here is on achieving a high degree of flexibility, minimising risks, optimising costs, while also focusing on sustainability.

Our approach is:

- To keep debt ratios low

- To have a high share of unencumbered assets

- To maintain a high liquidity reserve

- To have a wide range of financing sources

- To fully link long-term financing to the sustainable use of funds

We aim to be an attractive investment for our shareholders, and payment of ongoing dividends is one way we achieve this. Our dividend policy provides for the annual payment of dividends equal to 80 – 90% of our operating cash flows (as measured using the FFO I metric), with the aim of maintaining or growing its absolute level.