Story Detail

From box-ticking to impact

Nowadays, sustainability features on companies’ agendas across the board. The regulatory environment is increasingly set up in a way that makes the topic unavoidable, for example in the form of the EU’s CSR regulations. Another positive development is the improvement in the quality of reporting, not least thanks to the standards provided by the Global Reporting Initiative (GRI) and the International Integrated Reporting Council (IIRC). These standards not only help to make the range of different non-financial topics more concrete, but also improve comparability.

A glance at their implementation, however, frequently leads one to suspect that this is only the beginning. From the perspective of company management, sustainability often remains «a topic», but not «the topic». The question that seriously needs to be asked is this: is consistent dedication to sustainability goals an integral part of the business model, or is it just part of the company image? And how does this approach change our usual way of thinking – one which, in a business context, often differentiates between «hard» and «soft» performance indicators?

Non-financial KPIs an indication of long-term value creation

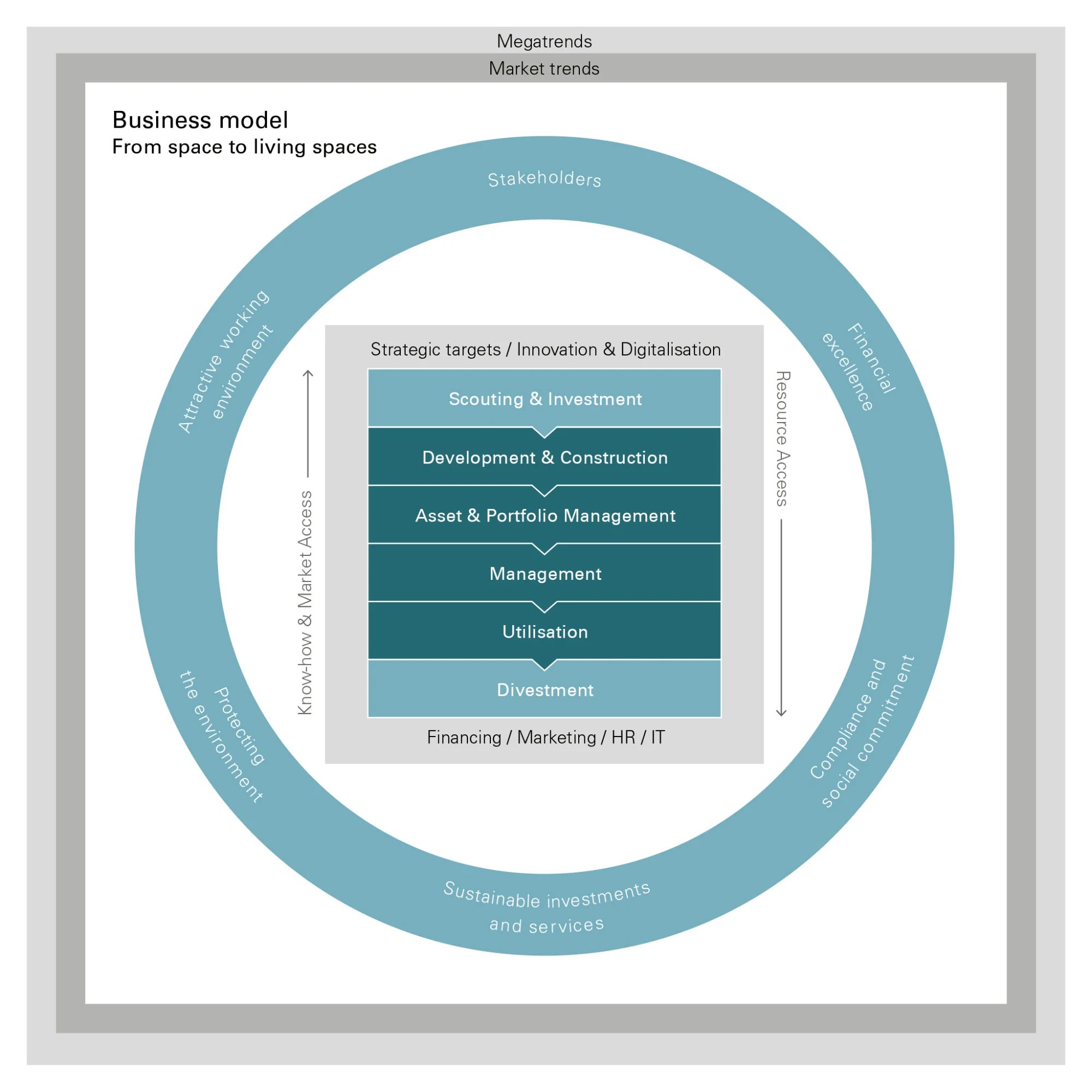

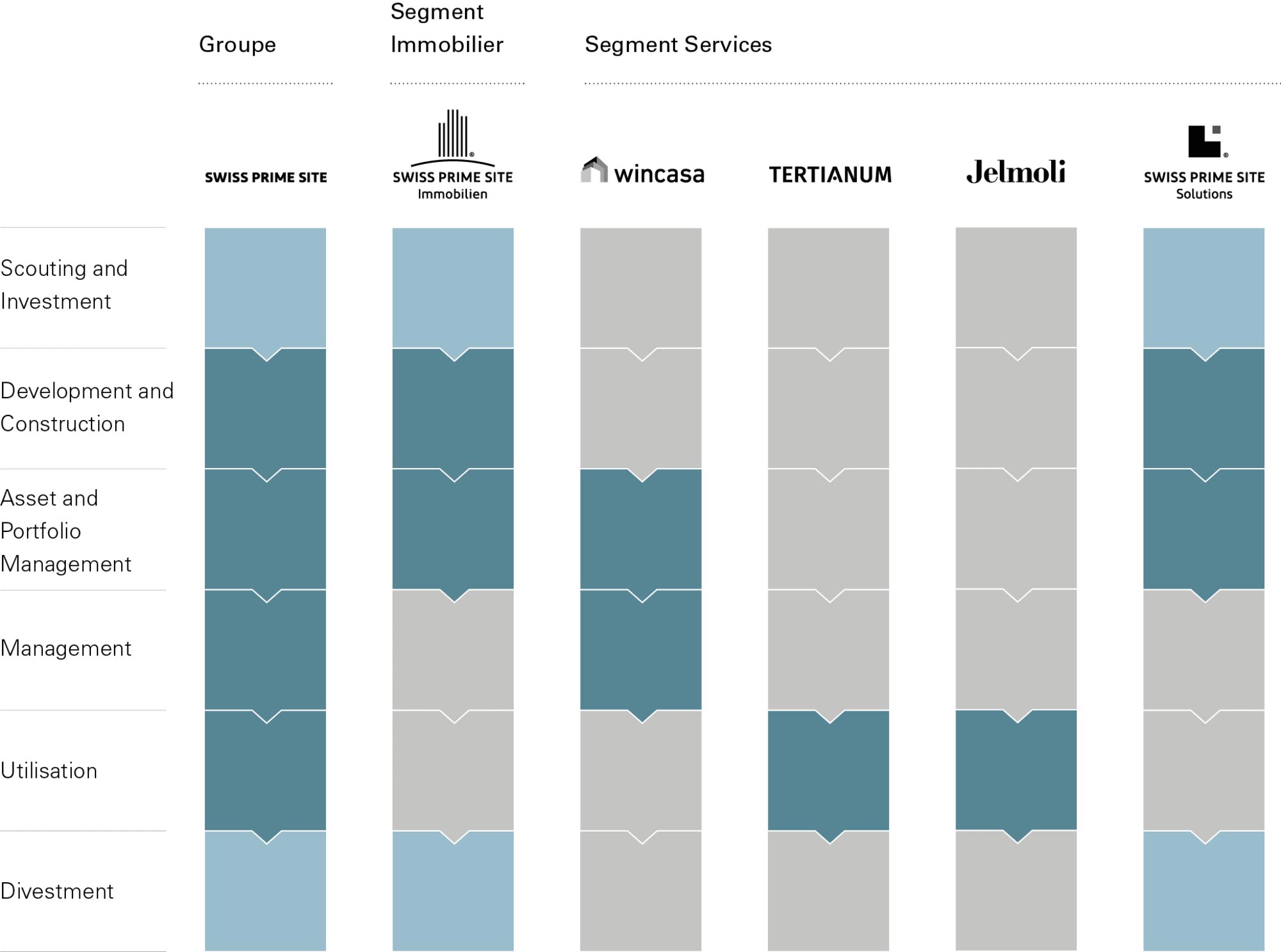

A modern view of sustainable management sees a company as a «value creation machine» that creates value in a variety of different ways. Financial success is supplemented by value creation for customers, employees, society and the environment. This is the approach taken by Swiss Prime Site, the largest listed real estate company in Switzerland. Building on the GRI sustainability reporting guidelines, which were introduced several years ago, the 2017 Sustainability Report applied the principles of «integrated reporting» for the first time.

This had various implications. Firstly, Swiss Prime Site’s business model and that of its group companies was presented as an «integrated value creation model». Secondly, it offers a different perspective in terms of time frame. The focus is increasingly on a forward-looking perspective and the development of long-term goals. In addition, trends are analysed and the risks and opportunities for future development assessed. The reporting itself thus becomes a strategic management tool. Thirdly, a business model requires input in order to achieve output and to have an impact. To achieve this, Swiss Prime Site applies the six capitals of the IIRC standard: financial capital, manufactured capital (relating to infrastructure), intellectual capital, human capital (in the form of employees), relationship capital (relating to customers and stakeholders) and natural capital. In the report, explicit KPIs for both input and output in all Swiss Prime Site’s business areas were developed for the first time. This process is by no means over. The capitals mindset will become part of the company culture as a management instrument and increase the focus on effective long-term success factors.

Non-financials as early indicators

Financial success remains the main focus. Non-financials often run on a different time scale and, if correctly integrated and interwoven, can act as early indicators of financial success that will only become measurable at a later date. This is evident with regard to such issues as customer and employee satisfaction, but less so in the case of, say, climate change. Swiss Prime Site has set a long-term goal and wants to do its part in limiting global warming to under 2°C. This science-based target requires that the property portfolio and the management of the group companies be analysed in detail with regard to CO2 emissions. As this not only includes direct energy usage in the properties but also the supply chain and use by third parties, meaningful performance indicators need to be gradually introduced. At the same time, assessments based on climate change scenarios are being developed which will help build resilience against environmental risks that threaten the property portfolio. Alongside contributions to environmental protection, assurance is needed that the properties can continue to be operated comfortably for users in the long term in various climate scenarios within a reasonable budget.

Integrated thinking as the basis for adaptability

At Swiss Prime Site, sustainability and innovation are managed in the same division. This enables an integrated approach to value creation. Take an example: in 2019, Swiss Prime Site is addressing the overarching topic of climate change. During innovation and accelerator workshops, participants develop and evaluate ideas for new services while considering the wide-ranging potential negative effects of global warming and the associated health risks, regulatory requirements, etc. The capitals are applied right away when assessing the ideas, and additional uses and the non-financial impact are considered alongside the financial perspective. This strengthens the overall capacity to anticipate future developments and react more quickly to possible changes – in other words, it improves the company’s ability to adapt.

The original text by Urs Baumann and Dr Stephan Lienin was published in the article «From box-ticking to impact» in edition no. 14 of «The Reporting Times», the Center for Corporate Reporting (CCR)’s magazine.

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/user_upload/redakteure/stories/2019/Der_ganzheitliche_Weg_zur_Nachhaltigkeit/CO2-Kennzahlen_11.jpg)